ATD Blog

Tech Headlines for March 2015

Tue Mar 03 2015

Tech headlines for March 2015 include top LMS rankings, e-learning salary infographic, Saba acquired by Vector Capital, and new MOOC whitepaper.

2015 Top LMS Rankings

Craig Weiss, named the most influential person for e-learning on the industry's “Top Ten” annual list globally, has published his annual State of the LMS Industry Report for 2015 on his blog “E-Learning 24/7 Blog.” His report contains an independent analysis of 645 Learning Management Systems from all over the world.

The ranking is based on different criteria such as support and service, user interface and general features. Here’s a look at the top 10 LMSs.

#10 IMC Learning Suite: An all-around super performer. The UI on the front-end is good, the back-end needs improvement, but the feature sets and capabilities are robust.

#9 LearnUpon: Continues to get better each year. Very slick UI. Buy today, can go live today (i.e., self-service platform). Multi-tenant, strong feature set.

#8 CM-Group Luminosity: Very slick UI, front and back end. Strong feature set, mobile is very robust, gamification is solid, social is there.

#7 Blackboard – Higher Education: BB is back in town. The UI is very nice, especially on the front-end. Feature set for HE is at top tier status, and the mobile UI experience continues to get better.

#6 Docebo: Rock star! UI is very slick for front- and back-end. Weiss still loves the one-click app into the platform, and the inclusion of content into the LMS.

#5 Unicorn Training SkillsServe: Financial Services mega-star. The feature set is outstanding, UI for front-end is very nice, especially the home dashboard and favorites. Built-in authoring tool could easily be sold as a stand-alone it is that good.

#4 Frog: Jumping high once again, it is the best K-6 system. Period.

#3 eLogic Learning eSSential Plus: Takes it up another notch with some serious major wins. Also, it is being enhanced—with a new look and feel coming by end of Q1. Mobile strong, and gamification is coming.

#2 ExpertusOne: The former #1 for the last 3 years is now number two. The reason for the drop: fewer forward-thinking enhancements. That said, this is a very strong system, with its predicative analysis (the first to do it), home-learner dashboard, geolocation in the mobile app, gamification, and awesome UI.

#1 Growth Engineering: By far the most modern, hip front- and back-end in the industry with regards to learner and admin. One of the very few systems that a learner can have fun using. It is constantly adding new features and capabilities. Mobile is rolling out—to include on/off synch and native app with xAPI.

For more detail and insights from Craig, go to http://elearninfo247.com/2015/01/27/top-10-lmss-of-2015.

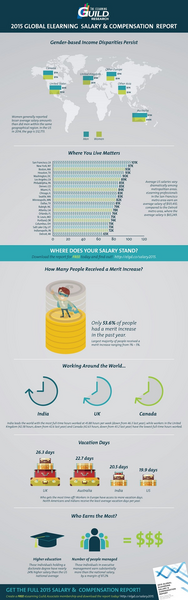

Infographic: 2015 Global E-Learning Salary & Compensation

The 2015 Global eLearning Salary & Compensation Report Infographic gives some of the highlights from The eLearning Guild’s 2015 Global eLearning Salary & Compensation research report, which examines trends in pay for eLearning professionals, exploring global and regional salary trends and breaking down salary by variables including industry and company size.

The report is based on the responses of 5,127 The eLearning Guild members, who provided their salary and compensation information as part of their membership data. The 2015 Global eLearning Salary & Compensation Report Infographic highlights gender-based income disparities, salary differences among Unites States metropolitan areas, how many people received merit increases in the past year, hours worked per week around the world, who gets the most vacation days, and who earns the most.

Saba Agrees to Be Acquired by Vector Capital

In February, Saba announced that it has entered into a definitive agreement with affiliates of Vector Capital (“Vector”) under which an affiliate of Vector will acquire all of the outstanding shares of Saba common stock for $9.00 per share in an all cash offer.

“Over the course of Saba’s comprehensive review, the Board of Directors and our advisors evaluated a wide range of strategic alternatives, and engaged with a number of parties. We are pleased to have reached this agreement with Vector, which provides significant cash value for our shareholders. Our Board unanimously believes that this is the best outcome for Saba, our shareholders, customers, partners and employees,” said Bill Russell, Saba’s Non-Executive Chairman.

“Over the last 17 years, Saba has delivered a growing set of innovative intelligent talent management solutions, which are in use today by more than 2,200 global market leaders and innovators,” said Shawn Farshchi, president and CEO of Saba. “Vector has been a great partner to Saba since 2013. We are thrilled to continue the relationship, and take advantage of the support and resources of Vector and their partner network to strategically invest in expanding our product portfolio, further our customer success programs, and continue to the next stage of the company’s growth and market leadership.”

“Vector, along with some of the world’s premiere financial institutions and investors, are excited to help Saba move beyond its financial restatement process and put the focus squarely on the Company’s innovative cloud talent management platform and its blue chip customer base,” said David Fishman, Managing Director and Head of the Private Equity Team at Vector Capital.

Andy Fishman, Managing Director at Vector Capital, said, “We are excited to partner with the management team and the dedicated and talented group of employees at Saba. We look forward to them becoming part of the Vector family.”

The transaction is subject to customary closing conditions and the approval of Saba shareholders, and is expected to close in the coming months. The transaction is not subject to any financing conditions. Saba senior management is expected to remain in Redwood Shores.

Morgan Stanley & Co., LLC is acting as financial advisor to Saba, and Morrison & Foerster LLP is acting as Saba’s legal advisor. Shearman & Sterling LLP is acting as Vector’s legal advisor.

Docebo Whitepaper Sheds Light on Future of Corporate MOOCs

A new whitepaper from Docebo, MOOCs: from Academia to Corporate, explores the genre’s popularity in the corporate learning world and its future viability in the academic world.

According to the whitepaper, on massive open online courses (MOOCs) are still struggling to find a market niche within the corporate world—since it’s difficult for any but the largest corporations to generate a following around a subject that they’re willing to make freely available to everyone. On the other hand, MOOCs seem to abound in the academic world. But those offering the MOOCs are now wondering how to make money from the intellectual property that comprises these courses.

Josh Squires, Docebo’s chief operating officer, argues that, while the idea of millions of people collaborating on a single subject in a shared learning environment is exciting, in reality MOOCs are unlikely to attain their original promise. Squires believes that MOOCs provide greater access to learning and a wider range of knowledge from different cultures and countries but technology isn’t beneficial merely because it’s there.

Nonetheless, MOOCs have already shown their potential to disrupt the academic and corporate learning worlds—in terms of price, technology, and even pedagogy—even if research shows that MOOC participants tend to come from the already well-educated and privileged in society.

The whitepaper is the result of a recent webinar, which featured a lively discussion between four online learning specialists:

John Leh, CEO and lead analyst at Talented Learning, an LMS selection consultant who helps organizations plan and implement technology strategies that support extended enterprise learning.

Dr. Mike Orey, an associate professor at the University of Georgia.

Aaron Silvers, a designer, technologist, and strategist responsible for helping to bring massively adopted learning technologies into organizations around the world, notably SCORM and xAPI (otherwise known as Tin Can). He also leads the IEEE Learning Technology Standards Committee charged with the international industry standardization of the xAPI.

Erica LeBlanc, the operations development manager for the IP and Science division of Thomson Reuters, where she manages a team of instructional designers focusing on the creation and delivery of customized sales training courses.

In addition, the whitepaper addresses 10 MOOC-related questions:

What’s a MOOC?

What’s the future for MOOCs?

From a corporate perspective, what types of MOOCs are there? How are they being implemented and why would a corporation want a MOOC?

Are MOOCs really a disruptive force in learning?

What’s the primary benefit to businesses offering MOOCs?

Will MOOCs up-end the fundamental structure of teaching, especially in a corporate setting?

What will be the effect of MOOCs in developing countries and immature learning markets?

How do you see corporate acceptance of MOOC-based education?

How can you close the gap between MOOCs’ high enrolment and low completion rates?

Are MOOCs actually disrupting anything?

Squires comments: “There are models that have proven successful within some organizations so, if your heart is set on a MOOC, there’s a case to be made to launch one. However, you should examine your business requirements and evaluate whether a MOOC is needed to solve your issue, or whether some high quality, targeted learning can achieve your objective.”

To learn more, download MOOCs: from Academia to Corporate via the Docebo's website, or check it out on SlideShare.

You've Reached ATD Member-only Content

Become an ATD member to continue

Already a member?Sign In