Newsletter Article

Member Benefit

Data File: Real-Time Collaboration

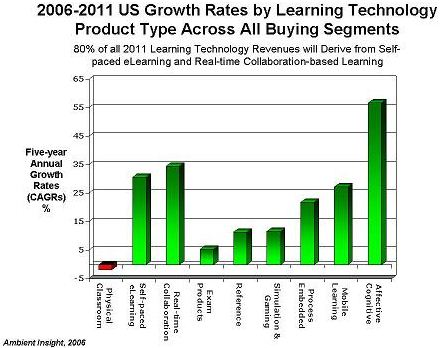

Here's a closer look at the growing demand for real-time collaboration-based learning. According to recent Ambient Insight market research, the 2006 U.S. market for real-time collaboration-based learning products and services is now over $2.6 billion and growing at a five-year compound annual growth rate (CAGR) of 34.5 percent. In...

SA

By

Sat Jan 13 2007

Loading...

You've Reached ATD Member-only Content

Become an ATD member to continue

Already a member?Sign In

Advertisement