ATD Blog

Designing an Effective Financial Literacy Program

Fri Feb 17 2017

What is the right level of financial literacy for your management team? The answer is not clear-cut. It depends on the organizational culture and the expectations of top management. Does top management expect its leaders to use financial information to drive their decision-making process? What level of financial expertise do they require of their management team?

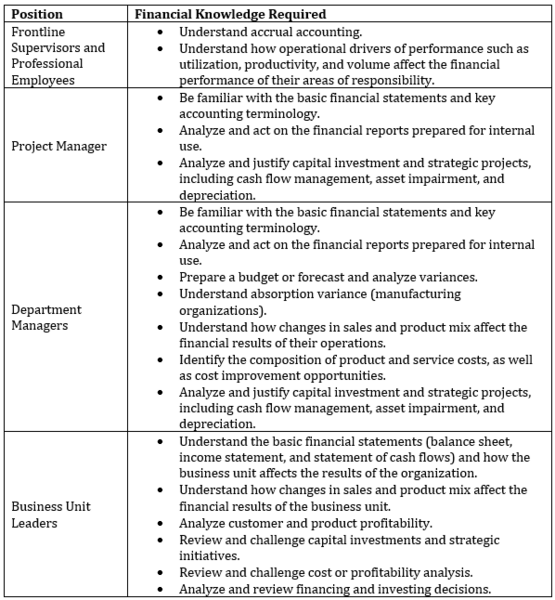

Based on my experience in working with nonfinancial professionals over the years, I have developed a table that summarizes the basic levels of financial literacy that are needed at different levels of management. This table can be used as a first step in designing an effective financial training program for nonfinancial managers.

Financial training programs for nonfinancial managers must start with the basic financial and accounting terminology that underlie the preparation of financial statements, and build from this knowledge. If managers do not understand the big picture and how they affect the financial results, it will be difficult to relate the day-to-day operations with the financial performance of the organization. Online learning can provide your team with the fundamental building blocks to understand and use financial information while minimizing your investment in time and cost. It can help create a common language to communicate financial information and provide measurable results to assess learning retention over time.

As managers move up the organizational hierarchy, other types of financial skills will gain more importance, such as how to analyze budget variances, product and customer profitability, and departmental or business unit cost structure, as well as how to analyze and justify capital investments. The acquisition of these skills may require more customized solutions, which can be delivered online, through a blended learning experience, or live instruction.

Below are some basic recommendations on how to design a financial literacy program for nonfinancial managers:

Determine the desired outcome. What do you want to achieve with this program? An example of a desired outcome would be to improve the ability of nonfinancial managers to plan and fiscally manage their areas of responsibility.

Identify the critical behaviors linked to these business outcomes. Examples of critical behaviors may be to link short-term objectives to resources, identify interdependencies with other areas, estimate costs, identify revenue or cost improvement opportunities, act on variances, and anticipate unforeseen situations.

Identify the financial skills required for each management level and the knowledge gaps in your team.

Develop a financial training program that is tailored to your work environment and has immediate applicability on the job. This program can be delivered live, online, or through a blended learning experience.

Provide a systematic mechanism so that managers can refresh financial concepts on a regular basis, whether online or in a short, facilitator-led session.

Evaluate the effectiveness of the training program and make adjustments as required.

Designing a financial literacy program tailored for each level of management is not an easy task. It is not a one-time, isolated event, whether it be a one-day seminar or a five-week training program. It requires an understanding of the financial skills needed per an employee's job responsibilities, identifying the knowledge gaps, developing content to fill these gaps with real-world applicability, and outcome assessment at periodic intervals to ensure that participants have learned and can apply the financial knowledge obtained. Finally, a successful financial literacy program should provide participants with opportunities to use their financial skills on a regular basis, and collaborate and share their knowledge with other individuals in the organization who may face similar challenges or opportunities.

Understanding financial jargon is like learning a new language. If you do not practice and use it, you’ll lose it. Financial literacy programs must start using technology to create a learning community so that managers can share their financial knowledge and experience with other members in the organization, anytime, anywhere, anyplace.

You've Reached ATD Member-only Content

Become an ATD member to continue

Already a member?Sign In